Advertisement

What does mint money do? Get to learn more about Mint instant loan requirements, eligibility, application process, and how to download Mint loan app for Android or iOs devices. The list of questions is practically endless and this post is specially baked to give you all the needed guide for a successful loan application on Mint loans.

Let’s dive in…

About Mint Loan – What is Mint loan?

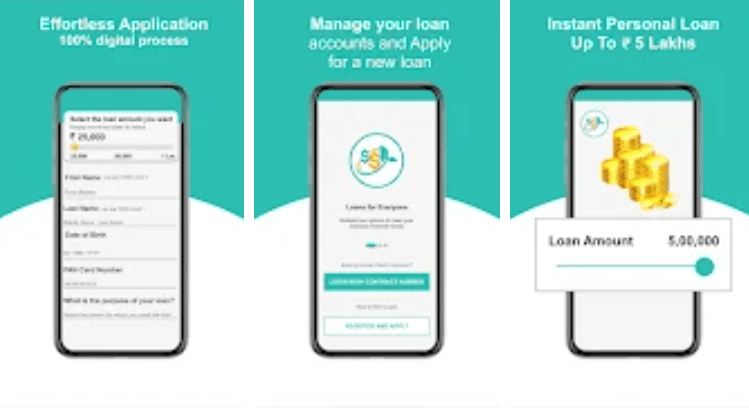

Mint Loan is a popular financial technology (fintech) platform that offers quick and convenient loan solutions to individuals in need of immediate funds. The platform provides an easy-to-use mobile application that allows users to apply for loans with minimal hassle. Mint Loan aims to simplify the borrowing process by leveraging technology to streamline application procedures, enhance user experience, and provide prompt loan disbursements.

With its user-friendly interface and hassle-free loan application process, Mint Loan App has become a popular choice for individuals seeking quick and convenient loans. We will guide you through the step-by-step process of applying for a loan using the Mint Loan App.

Key Features of Mint Loan:

- Easy Application Process: Mint Loan simplifies the loan application process, eliminating the need for extensive paperwork and lengthy approval times. The user-friendly mobile app enables borrowers to complete the application from the comfort of their own homes.

- Quick Loan Approval: The platform employs advanced algorithms to assess loan applications swiftly. By analyzing various factors such as income, credit score, and repayment history, Mint Loan determines loan eligibility efficiently, allowing borrowers to receive loan approval notifications promptly.

- Flexible Loan Options: Mint Loan offers a range of loan amounts and repayment terms to suit the diverse financial needs of borrowers. Users can select the loan amount and repayment duration that aligns with their specific requirements and repayment capabilities.

- Transparent Terms and Conditions: Mint Loan emphasizes transparency by providing borrowers with clear terms and conditions upfront. Before submitting the loan application, borrowers have the opportunity to review all relevant information, including interest rates, fees, and repayment schedules.

- Secure and Confidential: Mint Loan prioritizes the security and privacy of borrowers’ personal and financial information. The platform utilizes robust encryption techniques and follows industry best practices to ensure the confidentiality and integrity of user data.

- Efficient Disbursement: Once a loan application is approved, Mint Loan strives to disburse the funds quickly. The platform employs secure payment methods to transfer the loan amount directly to the borrower’s designated bank account, ensuring prompt access to the funds.

- Responsive Customer Support: Mint Loan maintains a responsive customer support team to address any queries or concerns that borrowers may have during the loan application process. Users can reach out to the support team via the app or other designated communication channels for assistance.

See also: UBA Loan Code: Requirements And How To Apply For UBA Loan

Advertisement

How To Apply For Mint Loan

Step 1: Download and Install the Mint Loan App

To begin your loan application process, you need to download and install the Mint Loan App on your smartphone. The app is available for both iOS and Android devices and can be easily found and downloaded from the respective app stores. Once the installation is complete, launch the app to get started.

Step 2: Create an Account

After launching the Mint Loan App, you will need to create a new account. Tap on the “Sign-Up” or “Create Account” button and provide the required information, including your name, email address, and mobile number. Choose a strong password and ensure you agree to the terms and conditions before proceeding.

Step 3: Complete Your Profile

Once you have successfully created an account, you will be prompted to complete your profile. This typically includes providing additional personal details, such as your date of birth, address, occupation, and income information. Accurate information is crucial to ensure a smooth loan application process.

Step 4: Determine Loan Eligibility

The Mint Loan App will analyze the information provided in your profile to assess your eligibility for a loan. The app’s algorithms consider various factors, such as your income, credit score, BVN, and repayment history, to determine the loan amount you are eligible for. It is essential to provide accurate and up-to-date information to increase your chances of approval.

Step 5: Select Loan Amount and Repayment Term

Once your eligibility has been determined, you will have the option to choose the loan amount you require and the repayment term that suits your financial situation. Carefully consider your needs and repayment capacity before finalizing these details.

Step 6: Provide Additional Documents

To verify the information provided and ensure the security of the loan process, the Mint Loan App may request additional documents. These documents typically include proof of identity (such as a passport or driver’s license), proof of income (such as pay stubs or bank statements), and proof of address (such as utility bills or rental agreements). Make sure to have these documents readily available to expedite the process.

Step 7: Review and Submit Application

Before submitting your loan application, take a moment to review all the details entered, ensuring accuracy and completeness. Double-check the loan amount, repayment term, and personal information to avoid any errors. Once you are satisfied with the information, submit your application by tapping on the designated button.

Step 8: Wait for Approval

After submitting your application, the Mint Loan App will process your request and evaluate it based on the provided information. The approval process may vary in duration, but the app strives to provide quick responses. You can monitor the status of your application within the app and expect to receive notifications regarding the decision.

Step 9: Receive Funds

If your loan application is approved, you will receive the funds directly in your bank account. The Mint Loan App typically utilizes secure and efficient payment methods, ensuring that your money reaches you swiftly. Be sure to check the provided bank account details for accuracy to avoid any complications.

Frequently asked questions about Mint loan:

What Is Mint Loan Interest Rate In Nigeria?

The Mint loan interest rate in Nigeria is 12% and 18%. However, short term loans and lower than the interest rate for long term loans. Mint loan tenure can span over 3 months to 12 months.

Does Mint let you borrow money?

Yes Mint loan let you borrow money, they make the process easy and instant.

Can you connect your bank account to Mint?

Mint Loans would require you provide a valid account number where the loan disbursement will be sent.

What is the USSD code for Mint loan?

As at the time we made this post, there was no available USSD code for Mint loans.

Conclusion:

The Mint Loan App simplifies the loan application process, allowing individuals to access funds quickly and conveniently. By following the step-by-step guide outlined in this blog post, you can navigate the application process seamlessly. Remember to provide accurate information, review your application

Advertisement