Advertisement

What is the code for UBA quick loan and how to borrow a loan from UBA bank are the most common questions by UBA active and potential customers who needed financial assistance through loans.

Whether you’re planning to start a new venture or need funds for personal reasons, accessing a convenient and reliable loan facility is essential. United Bank for Africa (UBA), one of Africa’s leading financial institutions, offers a seamless loan application process through its innovative loan code. This blog post will explore the requirements and guide you through the steps to apply for a UBA loan using the loan code.

Requirements for UBA loan application

Are you looking for UBA loan for salary earners or uba quick loan for non salary earners? Before you proceed with the loan application, it’s important to familiarize yourself with the requirements to ensure a smooth process. This will help you know how to qualify for a UBA loan. While the specific criteria may vary based on the type of loan you’re applying for, here are some common requirements for UBA loans:

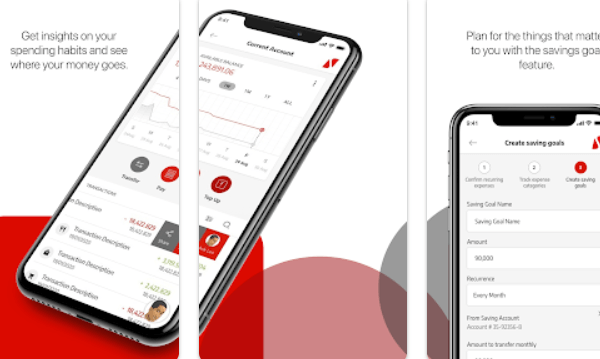

- UBA Account: To apply for a loan through the UBA loan code, you need to have an active UBA account. If you don’t have one, you can easily open an account by visiting any UBA branch or using the UBA mobile banking app.

- Valid Identification: You’ll be required to provide a valid means of identification such as a national ID card, international passport, or driver’s license. This helps verify your identity and ensures compliance with regulatory requirements.

- Proof of Address: UBA may request documents such as utility bills (e.g., electricity bill, water bill) or a tenancy agreement to confirm your residential address.

- Income Verification: Depending on the loan type, you may need to provide proof of income, such as salary slips, bank statements, or audited financial statements (for businesses). This helps UBA assess your repayment capacity.

- Collateral (if applicable): Some loan products may require collateral, such as landed properties, vehicles, or other valuable assets. The collateral serves as security for the loan.

Applying for a UBA loan using the loan code

UBA has introduced a simple and convenient loan application process using the loan code. Here’s a step-by-step guide to applying for a UBA loan:

See also: How To Get 50000 Instant Loan In Nigeria

Advertisement

Step 1: Dial the Loan Code

To begin the loan application process, dial the designated UBA loan code on your mobile phone. The specific code may vary based on your country of residence, so ensure you have the correct code for your location. Typically, the code will be a combination of numbers and symbols, such as *919*28#.

Step 2: Follow the Prompts

Once you’ve dialed the loan code, a menu of options will be displayed on your screen. Follow the prompts and select the loan option that suits your needs. UBA offers various loan products, including personal loans, business loans, and salary advance loans. Choose the option that aligns with your requirements.

Step 3: Provide the Required Information

After selecting the loan type, you’ll be prompted to provide the necessary information. This may include your UBA account details, personal details, employment information, loan amount, and repayment tenure. Ensure that you enter accurate information to expedite the loan processing and approval.

Step 4: Accept the Terms and Conditions

Before finalizing the loan application, carefully review the terms and conditions associated with the loan product. This includes interest rates, repayment terms, and any additional charges. If you agree to the terms, confirm your acceptance to proceed with the application.

Step 5: Await Loan Approval

Once you’ve submitted your loan application through the UBA loan code, the bank will review your application and assess your eligibility. The approval process may take some time, depending on the loan amount and complexity. UBA will notify you of the loan approval status via SMS or email.

Step 6: Disbursement of Funds

If your loan application is approved, UBA will proceed with the disbursement of funds. The disbursement process may vary depending on the loan type and your preferred method. Generally, UBA offers various disbursement options such as crediting your UBA account, issuing a check, or transferring funds to your registered mobile money account.

Step 7: Repayment

After receiving the loan funds, it’s important to adhere to the agreed-upon repayment schedule to avoid any penalties or default charges. UBA provides different repayment options, including automatic deductions from your UBA account, standing orders, or direct payments at any UBA branch. The duration often spans over a period of 12 months with an interest rate of 2.5% annually. Familiarize yourself with the repayment terms and ensure timely payments to maintain a good credit history.

Benefits of UBA Loan

- Convenience: The UBA loan USSD code offers a convenient and user-friendly platform for loan applications. With just a few simple steps, you can apply for a loan anytime and anywhere using your mobile phone.

- Time-saving: The UBA loan code eliminates the need for lengthy paperwork and physical visits to the bank. This saves you time and effort, allowing for a faster loan application and approval process.

- Accessibility: The UBA loan code is available to all UBA customers, making it easily accessible to a wide range of individuals and businesses across Africa.

- Flexibility: UBA provides various loan options tailored to different needs, including personal loans, business loans, and salary advance loans. This ensures that you can find a loan product that suits your specific requirements.

- Transparent Terms: UBA maintains transparency by providing clear terms and conditions associated with each loan product. This enables borrowers to make informed decisions and understand their financial obligations.

You can also make use of the UBA loan calculator online https://www.ubagroup.com/nigeria/help/tools-and-resources/ where you will be asked to enter the loan amount, the interest rate, and the duration so as to know your total repayable amount after UBA loan approval.

If you do not want to apply for UBA loan using USSD code, you can do so through a bank walk-in or via an online UBA loan application form. Simply download the customer loan application form and fill it with your details to begin the process.

Conclusion

The UBA loan code offers a convenient and efficient way to access loans from one of Africa’s leading financial institutions. By fulfilling the necessary requirements and following the step-by-step application process, you can apply for a UBA loan quickly and easily. Remember to carefully review the terms and conditions, and ensure timely repayment to maintain a healthy financial relationship with UBA. With UBA’s commitment to providing innovative banking solutions, the loan code serves as a valuable tool for individuals and businesses in need of financial support.

Advertisement