Advertisement

In today’s fast-paced world, where financial emergencies can arise at any moment, having access to quick and reliable loans can be a lifesaver. Traditional lending methods often involve lengthy paperwork, complex eligibility criteria, and time-consuming approval processes. However, with the advent of innovative financial technologies, borrowing money has become easier and more convenient than ever before. One such platform that has gained significant attention is the Easemoni Loan App.

What is EaseMoni loan app?

Easemoni Loan App is a cutting-edge mobile application designed to provide hassle-free and swift access to loans for individuals in need of immediate funds. It is built on the principles of simplicity, transparency, and customer-centricity, making it an ideal solution for emergencies, unexpected expenses, or fulfilling your dreams. The app is available for download on both iOS and Android devices, ensuring accessibility for a wide range of users.

Related: 5 Best Instant Loan Apps Without BVN In Nigeria

Features and Benefits:

- Seamless Application Process: One of the standout features of the Easemoni Loan App is its user-friendly and streamlined application process. With just a few clicks, users can complete the application, eliminating the need for extensive paperwork and physical visits to banks or financial institutions. The app also provides real-time updates on the application status, ensuring transparency throughout the process.

- Instant Loan Approval: Easemoni understands the urgency of financial needs, and that’s why their loan approval is lightning-fast. Upon submission of the application, the app’s advanced algorithms analyze the provided information and make an instant decision. This means you can receive loan approval within minutes, allowing you to address your financial requirements promptly.

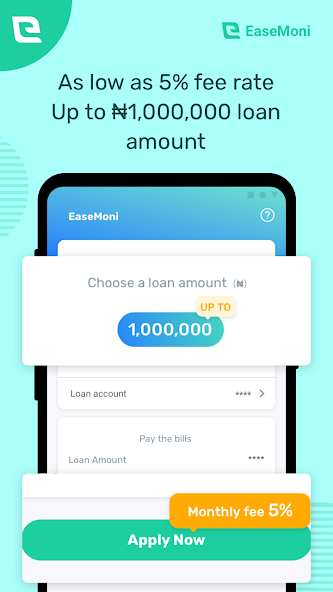

- Flexible Loan Amounts and Tenures: The Easemoni Loan App offers users the flexibility to choose loan amounts and repayment tenures that suit their needs. Whether you require a small loan to cover immediate expenses or a larger sum for a significant investment, the app caters to a wide range of financial requirements.

- Competitive Interest Rates: Easemoni understands the importance of affordability, and therefore, they offer competitive interest rates on their loans. The app provides transparent information regarding interest rates and charges, ensuring that borrowers have a clear understanding of their financial obligations.

- Secure and Confidential: Maintaining the security and confidentiality of user data is a top priority for Easemoni. The app employs robust security measures, including encryption and data protection protocols, to safeguard user information. You can trust that your personal and financial details are in safe hands.

- No Hidden Fees: Easemoni believes in complete transparency, and therefore, they ensure there are no hidden fees or charges associated with their loans. All applicable fees, including processing charges, are communicated upfront, allowing borrowers to make informed decisions.

- Convenient Repayment Options: The Easemoni Loan App offers various repayment options, allowing borrowers to choose the method that best suits their preferences. Whether it’s through direct debit, online transfers, or auto-debit arrangements, the app provides a hassle-free repayment experience.

How to borrow money from EaseMoni

The process of applying for an EaseMoni loan is as simple as the name. The loan approval process is very fast and almost instant you will have the loan disbursed into your bank account.

Step-by-step guide on how to apply for EaseMoni loan.

Advertisement

- Download the online apk EaseMoni loan app from your respective mobile app store, and register.

- Navigate to the loan option from the app menu.

- Select your desired loan and repayment plan.

- Review your selection and submit it.

- Verify your application with the verification code sent to you.

- Get approval almost instantly.

EaseMoni loan requirements

It is important to know the requirements for an EaseMoni loan so as to make sure everything is in place before you begin the loan application process.

To be eligible for the loan; You must be a citizen of Nigeria and resident in Nigeria. Age-wise, you should fall between the range of 20 and 55 years. A steady and reliable source of income is a must. Additionally, an operational bank account, a favorable credit score, and the provision of your BVN (Bank Verification Number) are necessary.

Furthermore, it is important to provide accurate information during registration as it directly impacts your creditworthiness. Lastly, an active email address and phone number are also required for communication purposes.

Frequently Asked Questions (FAQs)

How much can I borrow from EaseMoni for the first time?

First-time borrowers can get up to N3,000 from EaseMoni.

Is Easemoni approved by CBN?

Yes, EaseMoni has a microfinance license from the Central Bank of Nigeria (CBVN)

Which company owns EaseMoni?

Blue Ridge Microfinance Bank Limited owns the EaseMoni instant personal loan app.

Is EaseMoni legit?

EaseMoni is a registered loan app that can give you up to N1,000,000 without collateral. If you’re scared of getting into fake loan apps in Nigeria, EaseMoni is not one of them.

How can I pay back my Easemoni loan?

Login to EaseMoni app and tap on the “Repay” button to repay your loan. It is important to make your loan repayment on time so as to maintain a good credit score.

Conclusion:

In a world where financial emergencies can catch us off guard, having access to quick and reliable loans is essential. The Easemoni Loan App has emerged as a convenient and secure solution, providing users with a hassle-free borrowing experience. With its user-friendly interface, instant approvals, competitive interest rates, and transparent processes, the app has gained popularity among individuals seeking financial assistance. By leveraging technology and focusing on customer satisfaction, Easemoni has successfully positioned itself as a trusted platform in the lending industry. So, the

Advertisement