Advertisement

What is a secure password in UBA transfer? Have you ever heard of Secure Pass UBA USSD? It’s a special feature provided by United Bank for Africa (UBA) to make sure your banking transactions through USSD are safe and secure. Let me break it down for you.

First, let’s understand what USSD is. USSD is a technology that lets you access banking services using your mobile phone by dialing a short code. It’s like having a mini bank on your phone! With USSD, you can do things like transfer money, pay bills, check your account balance, and much more.

Now, let’s talk about Secure Pass UBA USSD. It’s all about adding an extra layer of protection to your USSD transactions. UBA cares about keeping your money safe, so they introduced this feature.

When you want to do certain high-risk transactions through USSD, like transferring money or making payments, UBA wants to make sure it’s really you who’s doing it. That’s where Secure Pass comes in.

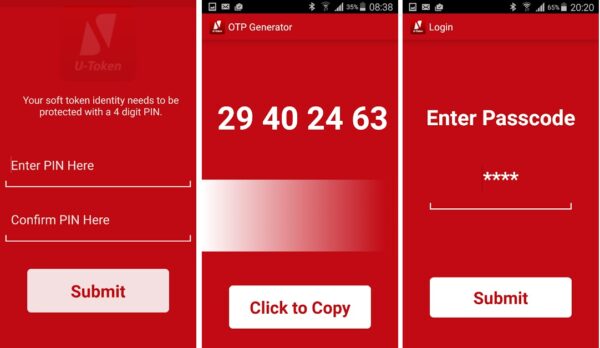

Secure Pass is a special application that generates a one-time password (OTP) on your mobile device. An OTP is like a secret code that changes every time you need to do a high-risk transaction. It’s unique to you and only valid for a short period of time.

Advertisement

Here’s how it works: When you’re about to do a high-risk transaction using USSD, UBA will ask you to enter the OTP generated by the Secure Pass app. This way, they can be sure it’s you and not someone else trying to access your account or steal your money. It’s an extra step, but it’s totally worth it for your security.

By using Secure Pass UBA USSD, you can have peace of mind knowing that your UBA account is well-protected. It’s like having a personal bodyguard for your money! You can download UBA secure pass app from the Playstore for Android or the iOS store for iPhones.

FAQs

How do I qualify for UBA Secure Pass OTP?

You need to create and have an active UBA account to become eligible for UBA secure pass OTP. This will add another layer of security to your online transactions.

What to do if I forgot my secure pass for UBA?

Walk-in is the solution we highly recommend for such cases. If you have issues with your secure pass for UBA, simply visit the nearest UBA branch and lay a complaint with their customer care unit. They will gladly assist you.

How can I increase my UBA transfer limit with secure pass?

With the secure pass, you can increase your limit from 200k to 1m using the UBA mobile app or fill out the e-indemnity form to increase your daily transaction limit to 5m or more.

Why is my UBA account not eligible for secure pass?

Every account owner is entitled to have access to a secure pass under normal circumstances.

Over to you

We hope you find our blog post on the UBA secure pass helpful. No matter what, it’s always important to keep your banking transactions secure and be aware of any security measures your bank provides. The bank will not be responsible for the loss of funds due to your own carelessness in allowing people access to your bank login details/user ID. Kept them safe and follow security measures as advised by your banks.

Featured image credit: Tellforceblog.com

Advertisement