Advertisement

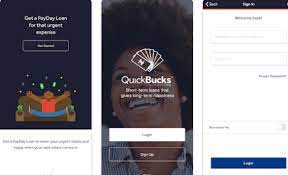

Access Bank PLC is the owner and operator of the loan application QuickBucks. This guarantees that both institutional clients and non-customers can easily get rapid loans. Since the program has been in use for almost five years, users have spoken favorably of its applicability, dependability, and speedy loan disbursement.

And to top it all off, the QuickBucks smartphone app has significantly decreased the length of lines at Access bank locations. This is purely a result of science and technology making a quantum leap.

QuickBucks: how does it operate?

Access Bank created the loan application QuickBucks to assist in offering financial aid and other services to both its clients and non-customers. Navigating the QuickBucks loan app is simple. You must first download the mobile app from the Google Play Store, create an account with QuickBucks, and then carry out your desired actions to get Access Bank services through QuickBucks.

In the interim, be prepared to present the required paperwork and satisfy the eligibility requirements. This is because before applying for a loan from Access Bank through QuickBucks, variables like your creditworthiness, personality, and others must be taken into account.

QuickBucks loan app

The QuickBucks lending app was made available on July 31, 2018, by Access Bank Plc. Over 500,000 people have downloaded the app, which has 3,000 reviews, a 3.3-star rating, and a 37 MB download size. QuickBucks is simple to use for the common individual thanks to its user-friendly UI. You can apply for the following loans using the QuickBucks Loan application:

Advertisement

- Payday loans,

- Salary advances,

- Little-ticket personal loans,

- Equipment financing,

- Auto loans, and mortgages

The QuickBucks loan app download process

If you follow the instructions below, you can download the QuickBucks loan application in a matter of minutes;

- Visit Google Play Store or app store.

- In the search box, type “Quickbucks”

- When you click “Install,” the program will download. But make sure you have around 40 MB of data.

Documents required for QuickBucks lending.

You must make sure that the following requirements are satisfied and the necessary documentation is supplied in order to be qualified to receive a loan from QuickBucks.

- A functioning bank account is a need. It is to your advantage if it is with Access Bank.

- a BVN(bank verification number).

- a valid NIN(national identification number).

- a legitimate email address

- A working telephone number

- a trustworthy and good source of income

How to apply for a loan with QuickBucks

You can follow the instructions below to apply for the QuickBucks loan you want.

- Visit the Google Play Store to download the Quickbucks lending app.

- Simply type “Quickbucks” into the search field to get started. After that, click “install” to start the download.

- Join the Quickbucks program. To sign up, click the signup button and input your email address and phone number with BVN.

- Your phone number will receive an OTP that will be needed to verify the app. Edit your profile and your personal information, including your address, bank account number, and monthly salary.

- By selecting your chosen password and 4-digit PIN (which will be used for transaction authentication), you have completed the signup procedure.

- Accept the terms and conditions, then submit the form and use your newly created credential to sign in.

- You can select any of the loan types you desire after signing up.

We suggest waiting a few minutes after submitting an application for the loan you want. The management team can now evaluate your application and give you the loan if successful.

The interest rate for QuickBucks loans

Quickbucks offers interest at a comparatively low rate. That amounts to around 4% of your principal.

QuickBucks loan app benefits

The advantages of using the QuickBucks lending app are as follows:

- The option to sign in using your email address or phone number and password is sufficiently flexible.

- Fingerprint authentication makes it simpler to access your account.

- The app offers a comprehensive picture of all lending products that are eligible.

- It is simple to view active loans.

Advertisement