Advertisement

Many people began to ask us questions about KashKash personal loan app after we published a post on Which loan app can give me 50000 Naira. Such questions include; How can I get a loan from Kashkash and Is Kashkash still working?

So, in today’s post on our loan app guide, we will extensively discuss the Kashkash loan application and requirements.

What is the Kashkash loan app?

Kashkash is a loan app that provides financial assistance to those in need. The app is designed to be user-friendly and easy to use. It offers a variety of loan options to fit different needs and budgets. To apply for a loan through Kashkash, there are certain requirements that must be met.

One of the requirements to apply for a loan through Kashkash is that the applicant must be at least 18 years old. Additionally, the applicant must have a steady source of income and a valid bank account. The loan amount that can be applied for depends on the income and credit history of the applicant.

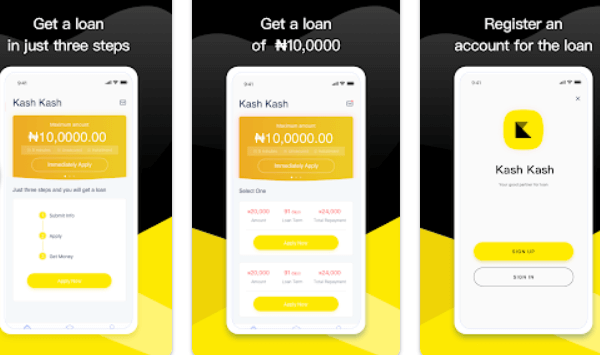

To apply for a loan through Kashkash, the applicant must first download the app and create an account. The app will then ask for personal and financial information, such as name, address, and income. Once the application is submitted, Kashkash will review the information and determine if the applicant is eligible for a loan.

Advertisement

Eligibility Criteria

To be eligible for a Kashkash loan, the applicant must meet the following requirements:

- Must be at least 18 years old

- Must be a citizen or permanent resident of the United States

- Must have a regular source of income

- Must have a valid phone number and email address

Additionally, Kashkash may consider other factors such as credit score, employment history, and debt-to-income ratio when evaluating an application.

Documents Required For Kashkash Loan

In order to apply for a Kashkash loan, the applicant will need to provide the following documents:

- Valid government-issued ID, such as a driver’s license or passport

- Proof of income, such as pay stubs or bank statements

- Proof of residence, such as a utility bill or lease agreement

- Bank account number.

How To Apply For Kashkash Loan

Downloading the App

To apply for a Kashkash loan, the first step is to download the Kashkash loan app from the App Store or Google Play Store. The app is free to download, and it is available for both iOS and Android devices.

Once the app is downloaded, the user needs to create an account to start the application process. The user will be asked to provide some personal information, such as their name, address, and phone number.

Registration

After downloading the app, the user needs to register by providing their personal information. The user will also need to create a password to secure their account.

Kashkash requires users to provide their employment information, such as their employer name, job title, and monthly income. The user will also need to provide their bank account information, such as their bank name, account number, and routing number.

Submitting the Application

Once the user has completed the registration process, they can start the loan application process. The user needs to provide information about the loan amount they need, the purpose of the loan, and the repayment term.

Kashkash also requires users to provide some additional information, such as their social security number, date of birth, and driver’s license number.

After submitting the loan application, the user will receive a decision within a few minutes. If the loan is approved, the user will receive the funds in their bank account within 24 hours.

Summary

Overall, the application process for Kashkash loan app is straightforward and easy to understand. By following the steps outlined above, users can apply for a loan quickly and easily.

Advertisement