Advertisement

Are you looking for a sharp loan to attend to a very urgent need, start up a business, or expand an already existing business? Paylater by Carbon has amazing loan options with friendly interest rates that will wow you. With the PAylater USSD code for loans, you can for sure access loan anytime.

One of the most amazing features of Paylater loan is the availability of USSD code for an instant loan. This gives room for every phone user to access loan hence they have a valid SIM card. This does not require internet access, you can get a loan offline with the help of USSD codes.

Honestly, there’s always a bill to pay, every day has its own billing waiting to be settled. Whether it’s an unexpected medical bill, a car repair, or a sudden opportunity you don’t want to miss, having access to quick funds can be a game-changer.

See also: How To Get 50000 Instant Loan In Nigeria

What is Paylater?

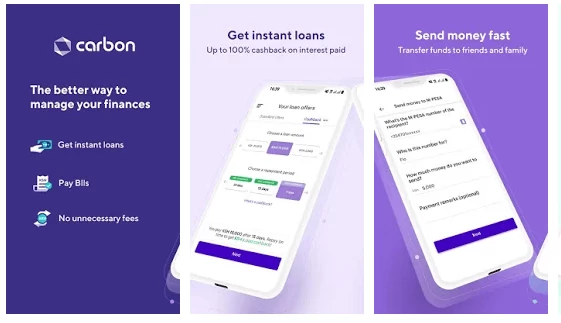

Paylater, also known as Carbon, is a leading fintech company that provides innovative financial solutions to individuals and small businesses. With a mission to make financial services more accessible and convenient, Paylater offers a range of services, including loans, bill payments, and investments.

Advertisement

Paylater, a renowned fintech company, offers a seamless solution to this problem through its USSD code for loan applications.

What is the USSD code for Carbon Paylater?

Paylater has introduced a USSD (Unstructured Supplementary Service Data) code to enable users to access their loan application process easier. USSD codes are shortcodes that can be dialed on a mobile phone to access various services without the need for internet connectivity.

To initiate a loan application using Paylater’s USSD code, follow these simple steps:

- Dial *1303# on your mobile phone.

- Select the loan option from the menu displayed on your screen.

- Follow the prompts to enter the necessary details, such as loan amount and repayment period.

- Submit the application and wait for a response.

By leveraging USSD technology, Paylater ensures that users can apply for loans even without a smartphone or internet access. This feature makes it highly accessible to a broader range of individuals, including those in remote areas or with limited connectivity.

Requirements for Paylater Loan Application:

Paylater has designed its loan application process to be user-friendly and hassle-free. While the specific requirements may vary, depending on your location and the loan product you choose, here are the general prerequisites:

- Mobile Phone: You need a mobile phone capable of dialing USSD codes.

- Network Connection: Ensure you have a working SIM card with network coverage.

- Bank Account: A valid bank account is essential for receiving the loan amount.

- Identification: You may be required to provide identification documents, such as a national ID card, driver’s license, or international passport.

- Employment Information: Paylater may require details about your employment, such as your employer’s name and address, to assess your loan application.

It’s important to note that meeting these requirements does not guarantee loan approval. Paylater employs a comprehensive evaluation process, taking into account various factors to determine the eligibility of an applicant.

Benefits of Paylater USSD Code for Loan Application:

- Accessibility: The USSD code allows anyone with a mobile phone to apply for a loan, eliminating the need for internet connectivity or a smartphone.

- Convenience: The simplicity of the USSD code enables quick loan application from anywhere, anytime, without the need for lengthy paperwork or branch visits.

- Speed: Paylater’s automated loan application process ensures a swift response, often providing instant loan decisions.

- Security: Paylater prioritizes data security and employs robust measures to protect your personal and financial information.

- Financial Inclusion: By offering a USSD code option, Paylater extends its services to a broader population, including those without access to traditional banking services.

Frequently asked questions

Does Carbon use USSD code?

Yes, Carbon used USSD code and as indicated in this blog post.

How do I register for Carbon Paylater?

To create your Paylater account, first, download the Carbon Paylater app from your Play Store or Appstore and follow the easy menu to signup.

Is Paylater the same as Carbon?

Yes, Paylater is the same as Carbon. In the year 2019, Paylater metamorphosized into what is now known as Carbon today.

How much loan can Carbon give?

The amount of loan that can be given to you depends on your eligibility, new users and users who have maintained good credit scores over time often have access to different loan options. Paylater can give from #30,000 to about #600,000 in loans without requiring too much paperwork.

Is Carbon loan approved by CBN?

Yes, Carbon is registered and approved by the Central Bank of Nigeria.

How do I withdraw my Carbon loan?

Your approved loan will be sent to your bank account number attached to your profile, that way you’re able to withdraw your Carbon loan with ease.

Conclusion:

Paylater’s USSD code for loan applications is a game-changer in the realm of financial services. With its accessibility, convenience, and swift processing, individuals can now tackle financial emergencies more effectively. By simplifying the loan application process, Paylater continues to redefine financial inclusion and empower users to access funds.

Advertisement