Advertisement

In Nigeria, you will agree with me that every day there’s a need for money to carry out one or more activities for the day. It could be to support your existing business or to start something new etc.

So, if you’re looking for which loan app to borrow loan from, or wondering what is the interest rate for Naira9ja loan is, here’s a special guide for you. I also made sure Naira9ja customer care number is included at the end of this post.

See also: 5 Best Instant Loan Apps Without BVN In Nigeria

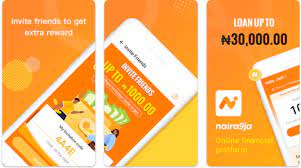

What is Naira9ja loan app?

Before delving into the application process, let’s gain a better understanding of the Naira9ja Loan App. It is a mobile application that offers instant loans to users in Nigeria. The app aims to simplify the loan application and disbursement process, making it accessible to a wider audience.

Requirements for Naira9ja loan app:

To qualify for a loan through the Naira9ja Loan App, applicants need to meet certain requirements. These requirements ensure that borrowers can repay their loans and reduce the risk for both parties involved. Here are the key requirements:

Advertisement

Age Limit:

Applicants must be at least 20 years old to be eligible for a loan through the Naira9ja Loan App. This requirement ensures that borrowers are legally capable of entering into a financial agreement.

Nigerian Citizenship:

The Naira9ja Loan App is exclusively available to Nigerian citizens. To apply for a loan, applicants must provide proof of their Nigerian citizenship, such as a valid identification document.

Bank Verification Number (BVN):

The Naira9ja Loan App requires applicants to have a valid Bank Verification Number (BVN). The BVN is a unique identification number issued by the Central Bank of Nigeria to facilitate seamless financial transactions.

Valid Bank Account:

Applicants must possess a functional bank account in Nigeria. The Naira9ja Loan App relies on this bank account for loan disbursement and repayment purposes.

Active Phone Number and Email Address:

A valid phone number and email address are crucial for communication and verification purposes. Applicants should ensure that the provided phone number and email address are active and accessible.

How to apply for a loan through Naira9ja loan app:

Now that we understand the requirements, let’s walk through the step-by-step process of applying for a loan through the Naira9ja Loan App:

Download and Install the App:

Start by downloading the Naira9ja Loan App from the official app store on your smartphone. Once downloaded, follow the installation instructions to set up the app on your device.

Registration:

Open the Naira9ja Loan App and proceed with the registration process. Provide the necessary details, including your name, phone number, email address, and BVN. Ensure that you input accurate information during this step.

Profile Setup:

After successful registration, set up your profile by providing additional details, such as your employment status, monthly income, and bank account information. The app may require you to submit supporting documents to verify the provided information.

Loan Application:

Once your profile is complete, navigate to the loan application section within the app. Specify the loan amount you require and select the repayment duration that suits your needs. Fill in any additional information required for the application.

Loan Approval and Disbursement:

After submitting your loan application, the Naira9ja Loan App will review your request. If approved, the loan amount will be disbursed directly into your registered bank account. Disbursement times may vary, but Naira9ja strives to ensure a prompt transfer.

Naira9ja Repayment and Interest Rates:

It’s important to remember that loans obtained through the Naira9ja Loan App are subject to interest rates and repayment terms.

Repayment Options:

The Naira9ja Loan App offers flexible repayment options to borrowers. Repayment can be made through the app using various methods, including bank transfers, mobile banking, or debit card payments. It is crucial to adhere to the repayment schedule to avoid penalties or additional charges. The repayment duration is usually 91 and 365 days.

Interest Rates:

Naira9ja Loan App applies interest rates to the loans provided. The interest rates may vary based on factors such as the loan amount, repayment duration, and the borrower’s creditworthiness. It is advisable to carefully review and understand the interest rates associated with your loan before accepting the terms.

Early Repayment:

If you wish to repay your loan before the agreed-upon due date, Naira9ja Loan App usually allows for early repayment. This option can help you save on interest charges, and it showcases your responsible financial behavior.

Benefits of Naira9ja Loan App:

The Naira9ja Loan App offers several advantages that make it an attractive option for borrowers:

Accessibility and Convenience: The app is readily available for download on smartphones, making it easily accessible to a large number of users. The straightforward application process and quick loan disbursement add to the convenience factor.

Fast Approval and Disbursement: Naira9ja Loan App is known for its swift loan approval process. Once your loan application is approved, the funds are disbursed directly to your bank account, allowing you to address your financial needs promptly.

No Collateral Requirement: One significant advantage of the Naira9ja Loan App is that it typically does not require borrowers to provide collateral. This feature ensures that individuals who lack traditional collateral can still access loans.

Credit Building Opportunities: By responsibly repaying loans through the Naira9ja Loan App, borrowers have the opportunity to build a positive credit history. This can enhance their chances of accessing larger loan amounts and better interest rates in the future.

Naira9ja customer care number: You can speak with their customer care agent on 0905 344 7778 or send an email to their official email address: help@naira9ja.cc. Naira9ja is located at Plot GA 1, Ozumba Mbadiwe Ave, Victoria Island, Lagos State, Nigeria.

Conclusion:

The Naira9ja Loan App provides a convenient and accessible solution for individuals and small businesses in need of quick financial assistance whenever you login and as long as you’re eligible for a loan. By meeting the necessary requirements and following the step-by-step application process, borrowers can access instant loans to address their financial needs. However, it’s crucial to use loans responsibly and ensure timely repayment to maintain a healthy financial profile. Remember to review the terms, interest rates, and repayment options before finalizing your loan agreement. With Naira9ja Loan App, obtaining a loan becomes a seamless and efficient experience for Nigerian borrowers.

Advertisement