Advertisement

Easybuy Loan is a specialized service provided by Palmcredit, a popular consumer loan platform. It aims to assist individuals who desire to buy mobile devices but lack the necessary funds. With Easybuy, you can conveniently purchase your preferred mobile phone and repay the amount in a way that suits you. Say goodbye to compromising on quality due to financial constraints when Easybuy is readily available to assist you.

How Does Easybuy Loan Work?

Easybuy is a loan service that allows individuals to purchase items and pay for them in installments. This service is especially useful for those who need to make large purchases but cannot afford to pay the full amount upfront. To use Easybuy, individuals must meet certain loan requirements and follow the application process.

To apply for an Easybuy loan, individuals must first find an Easybuy agent who will brief them on the requirements and ensure that they are eligible for the loan. The agent will ask questions and gather details to determine if the individual meets the necessary criteria. Once eligibility is established, the individual can proceed with the application process.

The loan requirements for Easybuy include a credit limit of N50,000 and two loan tenures: a 3-month tenure with 9% interest and a 6-month tenure with 6% interest. Additionally, users must make a 30% down payment before they can receive the loan. With these requirements in mind, individuals can apply for an Easybuy loan and enjoy the benefits of purchasing items on credit.

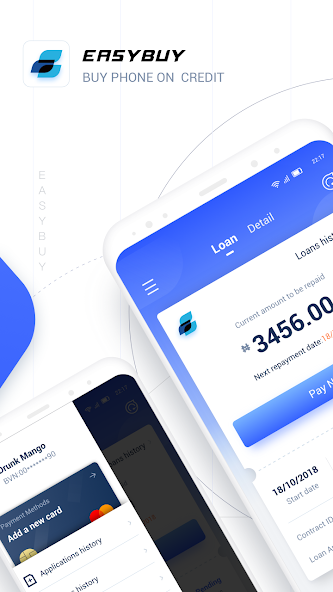

Easybuy Loan App Download

To access Easybuy’s services, you can download the Easybuy loan app from the Google Play Store. This user-friendly app enables you to manage your loan history, request new loans, and make repayments with ease. The Easybuy loan app boasts impressive features, offering a simple and intuitive interface. It has received over 1 million downloads, with over 50,000 reviews and an average rating of 4.0 on the Google Play Store. Moreover, the app has a small size, requiring only 6.4 MB to download.

Advertisement

How To Create An Account With Easybuy

Once you have downloaded the Easybuy loan app, you can proceed to create an account. Follow these steps to get started:

- Launch the app and click on “sign up.”

- Enter the required details, including your phone number, email address, and a strong password.

- Verify your phone number using the code sent to you.

- Accept the terms and conditions and submit your information.

- You will then be directed to the home page of the app, where you can begin utilizing Easybuy’s services.

EasyBuy Loan Application Requirements:

- Verified Means of Identification: Prepare a valid identification document, such as a driver’s license, international passport, voter’s card, or national ID card.

- Bank Verification Number (BVN): Provide your active BVN, as it helps in verifying your banking history and assists in preventing fraudulent activities.

- Automatic Teller Machine (ATM) Card: Have your active ATM card ready, as it will be required during the application process.

- Good Source of Income: Demonstrate a reliable source of income to establish your eligibility for an Easybuy mobile device loan. This gives Easybuy confidence in your ability to repay the loan within the agreed-upon timeframe.

- 30% Deposit: Ensure you have the 30% deposit of the total mobile phone amount you wish to purchase. This amount will be required for Easybuy’s intervention, with the remaining 70% covered by the loan.

Easybuy provides a transparent breakdown of the loan terms, interest rates, and repayment amounts. By calculating the interest rates based on the repayment plan you choose, Easybuy helps you make informed decisions regarding your loan. Remember to consider your financial capabilities and choose the repayment plan that suits you best.

Don’t let a lack of funds hinder you from owning the latest mobile devices. Embrace the opportunity Easybuy provides and join them today. Purchase your dream phone and enjoy the convenience of flexible repayments. Easybuy is here to make your mobile phone ownership experience affordable and accessible.

Benefits of EasyBuy Loan:

- Quick and convenient loan application process

- Flexible loan options for personal and business needs

- Competitive interest rates based on creditworthiness

- No collateral is required for personal loans

- Access to funds within a short period

- Repayment options tailored to your financial capabilities

- Improved credit history through timely repayments

How To Purchase With Easybuy

To buy your desired mobile phone using Easybuy, follow these steps:

- Locate an Easybuy agent, who can be found in affiliated mobile phone stores. You can identify Easybuy agents by their blue shirts with the Easybuy logo.

- Consult with the Easybuy agent, who will guide you through the requirements and ask relevant questions before proceeding with your purchase.

- After discussing your needs with the Easybuy agent, select your desired phone in consultation with the mobile shop’s manager, as Easybuy and the mobile

- shop collaborate closely.

- Once you have chosen your desired phone, proceed to the Easybuy loan app and register with the assistance of the agent, who will help you through the application process.

- The next step is to make a payment of the 30% deposit. Referring back to our previous example, if the phone is worth N50,000, you would pay N15,000, while Easybuy covers the remaining amount.

- Pay the 30% deposit to the mobile shop manager, who will coordinate with the agent to complete the transaction behind the scenes.

- Access your Easybuy loan app and set up your repayment plan. You can choose between the 3-month and 6-month repayment options. Each plan has its own interest rate, so consider your preferences and financial capabilities when making your selection.

- Provide the contact details of four individuals who can act as guarantors. These individuals should be people who can vouch for you and speak positively about your character and reliability. It’s advisable to inform them in advance about your loan application to avoid any surprises or inconveniences.

How To Apply For EasyBuy Loan

Easybuy is a loan service that allows individuals to purchase mobile phones on credit and pay later in installments. The application process is straightforward, and it can be done either online or in-person.

Online Application Process

To apply for an Easybuy loan online, the applicant needs to follow these steps:

- Find an Easybuy agent by visiting their website or using their mobile app.

- Provide the necessary details such as name, phone number, email address, and BVN.

- Select the mobile phone of your choice.

- Sign up for your Easybuy loan by providing income information and debit card details.

- Submit your application and wait for approval.

Once the application is approved, the applicant will receive a confirmation message and can proceed to pick up their phone from the designated store.

In-Person Application Process

For those who prefer to apply in-person, the applicant needs to follow these steps:

- Find an Easybuy agent by visiting their website or using their mobile app.

- Provide the necessary details such as name, phone number, email address, and BVN.

- Select the mobile phone of your choice.

- Provide income information and debit card details.

- Submit your application and wait for approval.

The Easybuy agent will guide the applicant through the process and provide any necessary information. Once the application is approved, the applicant can proceed to pick up their phone from the designated store.

How To Repay Easybuy loan:

- Mobile Transfer: Contact Easybuy through their email address to request their bank account details, and then make the payment via mobile transfer.

- Cash Payment at a Bank: Visit the nearest bank and make a cash payment. Ensure you have the necessary bank account details provided by Easybuy.

- Easybuy Mobile Loan App: Log in to your Easybuy account on the app, go to your loan history, select “repay the loan,” enter the desired payment amount and payment method, and submit. Wait for a debit alert and confirmation SMS from Easybuy. It’s recommended to take screenshots of your payment as a reference for any future discrepancies.

Repayment Terms and Methods

The loan duration with Easybuy typically ranges from 3 months to 6 months. You have two repayment plans to choose from:

- 3-Month Repayment Plan: Under this plan, you are expected to repay the loan within three months from the date of purchasing your mobile phone.

- 6-Month Repayment Plan: With this option, you have six months to repay the loan.

Frequently Asked Questions

How Much Can You Borrow From Easybuy?

Easybuy allows you to cover 70% of the value of your chosen mobile phone. However, the loan amount should not exceed N50,000. This means you can borrow as little as N10,000 or up to N50,000 through the Easybuy mobile loan app.

What Is Easybuy Loan Interest Rate?

The interest rate for Easybuy loans depends on the repayment plan you choose. Typically, the interest rates range between 6% and 9% per month. For the 3-month repayment plan, the interest rate is 9% per month, while for the 6-month repayment plan, it is 6% per month.

What will happen if I don’t pay easy buy?

If you don’t pay Easybuy, you risk being charged late payment fees and penalties. If you continue to miss payments, your credit score may be negatively affected, making it harder for you to obtain credit in the future. In addition, Easybuy may take legal action to recover the outstanding debt, which could result in legal fees and court costs. In extreme cases, Easybuy may repossess the item you purchased through its financing program. It is important to make payments on time or contact Easybuy customer support if you are experiencing difficulties making payments to avoid these consequences.

Easybuy Head Office and Contact Information

While Easybuy has agents present in various mobile shops, their head office is located at Number 9, Ogunnusi Road, Ogba, Ikeja in Lagos, Nigeria. For more information or to address any concerns, you can contact Easybuy through the following channels:

Phone number: 018888188

Email address: support@easybuy.com

Which loan company owns Easybuy?

Is Easybuy linked to Palmcredit? Easybuy is actually a mobile device financing platform operated by Palmcredit, a consumer loan company.

What is the interest rate for Easybuy phones?

The interest rate on Easybuy loans varies depending on factors such as the loan amount and repayment period. The average interest rate on an Easybuy loan starts from 8.99% to 29.99%, depending on the factors mentioned above.

Conclusion:

By understanding the loan requirements, following the straightforward application process, and utilizing flexible repayment options, borrowers can access the funds they need to fulfill their personal or business needs. With competitive interest rates and a commitment to providing excellent service, EasyBuy Loan stands as a reliable choice in the lending industry.

Honestly, Easybuy is committed to helping you purchase your desired mobile devices. Although the application process may seem thorough, it is designed to verify applicants and prevent fraudulent activities. Easybuy offers a reliable and convenient solution for acquiring your dream mobile devices. Joining Easybuy can provide you with the opportunity to enjoy the latest smartphones without straining your finances.

Remember, mobile phones have become increasingly expensive in today’s market, and Easybuy recognizes this challenge. With their loan services, you can overcome financial barriers and obtain the device you desire. Don’t compromise on the quality or features of your mobile phone due to a lack of funds when Easybuy is readily available to assist you.

By partnering with trusted mobile shops and employing dedicated agents, Easybuy ensures a seamless buying experience. Their agents, recognizable by their blue shirts adorned with the Easybuy logo, will guide you through the entire process. From selecting the phone to completing the transaction and setting up your repayment plan, they are there to assist you every step of the way.

The Easybuy loan app, available for download from the Google Play Store, empowers you to manage your loan history efficiently. With its user-friendly interface and features, you can easily request loans, track repayment progress, and make payments conveniently.

Advertisement