Advertisement

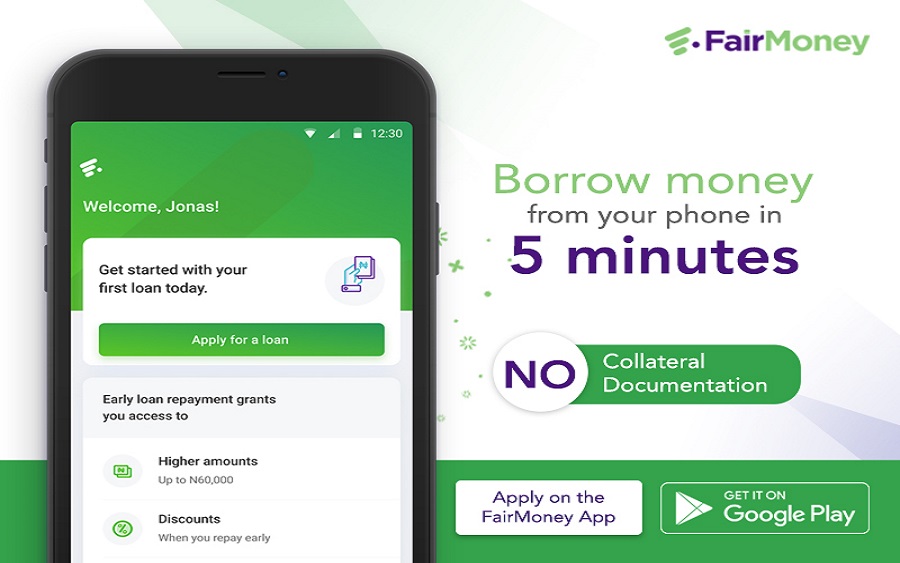

In today’s fast-paced world, financial emergencies can strike at any moment, leaving us in need of immediate funds. Fortunately, the advent of innovative financial technology has brought about convenient loan applications that can be accessed right from our smartphones. One such platform is FairMoney, an online lending app that provides quick and hassle-free loans to individuals.

FairMoney is a digital bank that offers instant loans to users in Nigeria. The app is available on both Android and iOS devices and provides a seamless and straightforward loan application process. Users can apply for a loan of up to N500,000 and receive a response within minutes.

To apply for a FairMoney loan, users need to download the app and create an account. The app requires users to provide personal details, including their name, phone number, and bank account details. Once the account is created, users can apply for a loan by selecting the loan amount and duration. The app provides a flexible repayment plan, and users can repay the loan through bank transfer or by funding their linked bank card with enough money to cover the amount due.

The FairMoney loan app has become increasingly popular among Nigerians due to its simplicity, instant disbursement of loans, and competitive interest rates. In this article, we will discuss the requirements for applying for a FairMoney loan and provide a step-by-step guide on how to apply for a loan using the app.

FairMoney Loan App Requirements:

Before diving into the application process, it is essential to familiarize yourself with the necessary requirements to ensure a smooth loan application experience. Here are the key prerequisites for obtaining a loan through the FairMoney app:

Advertisement

- Age and Residency: Applicants must be at least 18 years old and reside within Nigeria, where FairMoney operates.

- Valid ID: A valid means of identification is required. Acceptable identification documents include a National ID card, Permanent Voter’s Card, or International Passport.

- Bank Verification Number (BVN): FairMoney utilizes BVN to verify the identity of loan applicants and assess their creditworthiness.

- Employment Status: While FairMoney does not specifically require applicants to be employed, a regular source of income significantly increases the chances of loan approval.

- Mobile Phone and Internet Access: Since FairMoney is a mobile application, you will need a smartphone with an active internet connection to download and use the app.

How to apply for a FairMoney Loan:

Once you have ensured that you meet the requirements mentioned above, follow these steps to apply for a loan through the FairMoney app:

- Download the App: Visit the Google Play Store (for Android users) or the Apple App Store (for iOS users) and search for the FairMoney app. Download and install the app on your smartphone.

- Registration: Launch the FairMoney app and register with your phone number. Follow the on-screen instructions to complete the registration process, which may include providing personal information and creating a secure password.

- Provide Required Information: After registration, you will be prompted to provide additional details such as your full name, email address, BVN, and employment status. FairMoney uses this information to assess your loan eligibility.

- Loan Application: Once your account is set up, navigate to the loan application section within the app. Select the loan amount and duration that best suits your needs. FairMoney offers a range of loan options to choose from.

- Verification Process: FairMoney will use your BVN to verify your identity and assess your creditworthiness. Ensure that the information you provide during the application process is accurate and consistent with your official identification documents.

- Loan Approval and Disbursement: If your loan application is approved, FairMoney will notify you via the app and transfer the funds directly to your designated bank account. The disbursal time may vary, but FairMoney strives to provide quick access to funds.

Frequently asked questions about FairMoney loan

How much can I borrow from FairMoney for the third time?

The loan amount you can borrow from FairMoney for the third time may vary depending on several factors, including your repayment history, creditworthiness, and the loan products available at the time of your application. FairMoney typically offers loans ranging from ₦1,500 to ₦500,000 to eligible borrowers. However, it’s important to note that the maximum loan amount you can access may increase over time as you build a positive borrowing relationship with FairMoney and demonstrate responsible repayment behavior.

To determine the specific loan amount available to you for the third time, it’s best to consult the FairMoney app or website directly. The app will assess your eligibility based on your borrowing history and provide you with the available loan options tailored to your circumstances.

What happens if I don’t pay my FairMoney loan?

Defaulting on your FairMoney loan can have several consequences, which may vary based on the specific terms and conditions outlined in your loan agreement. It is crucial to understand the potential implications of not repaying your loan on time. Here are some possible outcomes:

- Late Payment Fees: FairMoney typically charges late payment fees for missed or delayed payments. These fees can accumulate over time and increase the total amount you owe. It’s important to review your loan agreement to understand the specific charges and penalties associated with late payments.

- Negative Impact on Credit Score: FairMoney may report your late or missed payments to credit bureaus. This can result in a negative impact on your credit score, making it more challenging for you to access credit in the future from FairMoney or other financial institutions.

- Collection Efforts: If you fail to repay your loan, FairMoney may initiate collection efforts to recover the outstanding amount. This can involve contacting you through various means, including phone calls, text messages, and emails. They may also employ third-party collection agencies to assist in the recovery process.

- Legal Action: In extreme cases of non-payment, FairMoney may take legal action against you to recover the outstanding debt. This can result in additional legal expenses and potential court judgments that may negatively affect your financial standing.

- Difficulty in Obtaining Future Loans: Defaulting on a FairMoney loan can make it challenging for you to secure loans in the future, not only with FairMoney but also with other lenders. Financial institutions consider your repayment history when assessing your creditworthiness, and a default can significantly impact your chances of obtaining credit.

Is FairMoney registered with CBN?

Yes, FairMoney operates as a financial technology (fintech) company that offers digital lending services through its mobile application. FairMoney complies with relevant regulations and licensing requirements, such as registration with the Corporate Affairs Commission (CAC)

What is FairMoney interest rate?

How much does FairMoney give at first?

The initial loan amount offered by FairMoney can vary based on several factors, including your creditworthiness, income level, and the specific loan products available at the time of your application. FairMoney typically offers ₦1,500 for the first time.

Can FairMoney borrow me 500k for the first time?

It is rare for FairMoney to borrow 500k loan to first-timers. The maximum loan amount you can receive from FairMoney as a first-time borrower may depend on various factors such as your creditworthiness, income level, and the specific loan products available at the time of your application. It’s important to note that loan amounts are subject to approval based on FairMoney’s assessment of your eligibility and ability to repay.

How much is FairMoney credit limit?

The FairMoney credit limit is 1,000,000 currently.

Conclusion:

The FairMoney loan app offers a convenient and efficient solution for individuals seeking immediate financial assistance. By meeting the app’s requirements and following the application process outlined above, you can increase your chances of securing a loan quickly and easily.

Advertisement