Advertisement

In today’s fast-paced world, access to instant and convenient financial solutions has become a necessity. Traditional banking systems often involve lengthy procedures, time-consuming paperwork, and cumbersome approval processes. However, with the advent of digital banking, the landscape has changed, offering users seamless and efficient financial services. One such platform is Kuda Bank, a digital-first bank that provides an array of financial products, including Kuda Loans.

What is Kuda Bank?

Kuda Bank is a leading digital bank in Nigeria, offering a range of innovative banking services through its mobile application. As a digital bank, Kuda provides users with a convenient and accessible platform to manage their finances, make payments, save money, and access loans. It aims to revolutionize traditional banking by providing a user-friendly and secure banking experience right at your fingertips.

What is Kuda Bank loans:

Kuda Loans are a core offering of Kuda Bank, enabling individuals to borrow money quickly and easily. These loans are designed to be hassle-free, with a streamlined application process and rapid disbursal of funds. Whether you need funds for emergencies, personal expenses, or business investments, Kuda Loans can be a reliable solution.

Key features and benefits of Kuda bank loans:

Accessibility: Kuda Loans are easily accessible to eligible individuals who have an account with Kuda Bank. With a few taps on your mobile device, you can apply for a loan anytime, anywhere, eliminating the need for physical visits to a bank branch.

Instant Approval: Kuda Bank’s loan approval process is fast and efficient. After submitting your loan application, you can receive approval within minutes, significantly reducing the waiting time associated with traditional loan applications.

Advertisement

Competitive Interest Rates: Kuda Bank offers competitive interest rates on its loans, ensuring affordability for borrowers. The interest rates are transparent, allowing you to make informed decisions when assessing your repayment capabilities.

Flexible Loan Amounts: Depending on your financial needs and creditworthiness, Kuda Bank offers a range of loan amounts. This flexibility allows you to borrow the required funds while ensuring your ability to repay them comfortably.

Repayment Options: Kuda Bank provides flexible repayment options, enabling you to choose a repayment tenure that suits your financial situation. The repayment can be made in installments, making it easier to manage your cash flow.

No Hidden Charges: Transparency is a key aspect of Kuda Bank’s loan offerings. You can rest assured that there are no hidden charges or additional fees associated with the loan, allowing you to plan your finances accurately.

How to borrow money from Kuda Bank:

Download the Kuda Bank App: To access Kuda Loans, you need to download the Kuda Bank mobile application from the App Store or Google Play Store. Install the app on your smartphone and follow the registration process to create your Kuda Bank account.

Complete your Profile: Once you have created an account, complete your profile by providing the required personal information and verifying your identity. This step ensures the security and compliance of your account.

Check Kuda overdraft eligibility: Before applying for a loan, assess your eligibility based on the criteria specified by Kuda Bank. Ensure that you meet the minimum requirements, such as age, income, and credit history.

Loan application: Open the Kuda Bank app and navigate to the loan section. Fill in the required details, including the loan amount and repayment tenure. Provide accurate information to improve your chances of loan approval. This is usually in the form of an overdraft.

Loan approval and disbursal: After submitting your loan application, Kuda Bank’s automated system will assess your eligibility and creditworthiness. If your application is approved, you will receive a notification regarding the loan offer, including the approved loan amount, interest rate, and repayment terms.

Accepting the loan offer: Review the loan offer carefully, ensuring that you understand the terms and conditions, interest rates, and repayment schedule. If you agree to the terms, you can accept the loan offer through the Kuda Bank app.

Disbursal of funds: Once you accept the loan offer, the funds will be disbursed directly to your Kuda Bank account. You can then utilize the funds for your intended purpose, such as paying bills, covering expenses, or investing in your business.

Tips for Responsible Borrowing:

While Kuda Loans offer convenience and flexibility, it is essential to practice responsible borrowing to maintain healthy financial habits. Here are a few tips to keep in mind:

Borrow What You Need: Only borrow the amount you genuinely need, considering your repayment capacity. Avoid taking on excessive debt that may strain your finances in the long run.

Plan for Repayment: Before accepting a loan offer, assess your ability to repay the loan within the agreed-upon tenure. Create a budget and ensure that you have a repayment plan in place to avoid any late payments or defaults.

Understand the Terms: Familiarize yourself with the loan terms, including the interest rate, repayment schedule, and any additional charges. Clear any doubts or queries before accepting the loan offer.

Regularly Monitor Your Account: Keep a close eye on your Kuda Bank account and loan repayment schedule. Set reminders for repayment dates to avoid missing payments and incurring penalties.

Avoid Multiple Loans: While Kuda Bank allows multiple loan applications, it is advisable to borrow responsibly. Taking on multiple loans simultaneously may increase your debt burden and affect your creditworthiness.

Frequently asked questions

What happens if I don’t pay my Kuda loan?

Kuda Bank will charge you 0.3% of the amount you borrowed every day until you pay.

Which bank is Kuda under?

Kuda is a microfinance bank registered under the Central Bank of Nigeria just as other microfinance banks.

How long can I use Kuda before I can borrow?

Only your regular use of Kuda Bank mobile app can determine how fast you will be eligible for an overdraft.

What does T3 mean in Kuda?

T3 simply means Tier 3. It represents an account that has passed BVN verification and has a valid government-issued ID card attached to the account.

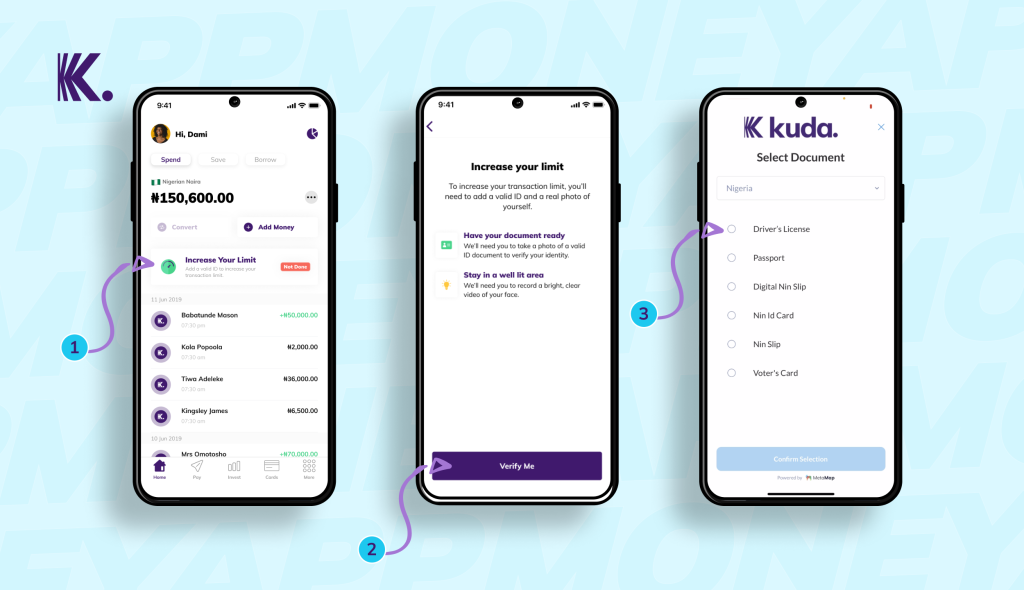

How do I upgrade my Kuda limit?

The processes involved in upgrading your Kuda account are very simple. Follow the instructions here to upgrade your Kuda limit.

What is the Kuda bank website?

The official Kuda website address is https://kuda.com/ from where you can access their contact page, customer care number, email address, and everything available on their website. Always make sure you are on the correct website to avoid fraud.

Conclusion:

Remember, responsible borrowing is crucial to maintain financial stability. Before applying for a loan, evaluate your needs, assess your repayment capacity, and plan your finances accordingly. By leveraging Kuda Loans wisely, you can address your financial requirements while building a strong credit profile.

Advertisement