Advertisement

Users in Nigeria can apply for personal loans through the loan app Unique Money. Both Android and iOS smartphones support downloading the app. Users need to submit some basic information while applying for a loan, including their name, email address, phone number, and bank account information.

A copy of their passport or national ID card is also required. Loan amounts offered by Unique Money range from 4,000 to 50,000. The annual percentage rate for loans is 24%. These loans must be repaid within three to six months.

Users need to have a strong credit score in order to be approved for a loan from Unique Money. They also need to be employed and make at least 20,000 per month in income. Applying for a loan from Unique Money is a quick and simple process. The application is typically evaluated and accepted within 24 hours after submission. The borrower’s bank account is then credited for the loan amount.

The Central Bank of Nigeria (CBN) oversees this legal loan app Unique Money. In Nigeria, the app has thousands of users and a positive reputation. The loan application from Unique Money has the following advantages and disadvantages:

Highlights

- The fast and simple application process

- Affordable interest rates

- Flexible terms for repayment

- Legitimate and under CBN control

Drawbacks

- High rates of interest

- 4,000 as the minimum loan amount

- A rapid repayment schedule

- Requiring a high credit score

How to apply for Unique Money Loans

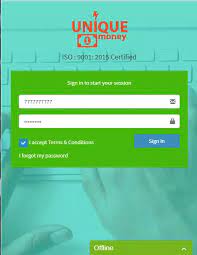

A Unique Money loan application can be submitted quickly and easily. The steps are as follows:

Advertisement

- From the Apple App Store or Google Play Store, download the Unique Money app.

- Create an account and enter some basic data, like your name, email address, contact information, and bank account information.

- Give a copy of your passport or national ID card.

- Post a selfie of you holding your ID card.

- Wait for the review of your application. Normally, the review procedure takes 24 hours.

- The loan money will be transferred into your bank account if your application is accepted.

When requesting a loan from Unique Money, you might need to present the following documents:

- Passport or a national ID card

- a three-month rolling bank statement

- Income documentation, such as a paystub or tax return

- Selfie with your ID card in hand

- Additionally, Unique Money might ask you for details about your employment situation and monthly spending.

If you are given approval for a Unique Money loan, you must pay it back within the allotted repayment time. Normal payback terms range from three to six months. You have the option of paying back the loan in full or in installments.

Loans from Unique Money have an annual interest rate of 24%. Accordingly, if you borrow 50,000, your total repayment obligation will be 56,000. You will need to pay the repayment amount in equal monthly installments that will be divided into equal halves.

Conclusion

The Central Bank of Nigeria (CBN) supervises the Unique Money. In Nigeria, the app has thousands of customers and a positive prominence. Before you apply for a loan, it’s crucial to evaluate the interest rates and costs charged by various lenders. Before you take out a loan, you should confirm that you can afford the monthly installments.

Advertisement