Advertisement

How to register Okash loan and how do I get a loan from Okash, these are common questions most people ask on the internet today including how to go about the Okash loan app download. That’s why we’ve specially written this post to serve as a special guide to everyone asking the same or similar questions regarding instant loan apps in Nigeria that one can borrow money from without collateral or a guarantor.

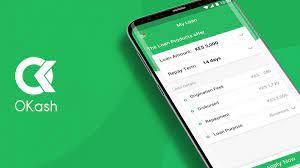

The Okash loan app is a popular mobile loan app that offers quick loans to individuals without collateral. To apply for a loan using the app, one needs to follow a few simple steps.

When applying for a loan using the Okash loan app, one needs to have a smartphone with an Android operating system. The app is only available for Android users. Additionally, one needs to be between 20-55 years old and have a valid phone number. The phone number is necessary for processing the loan application. The app requires the user to provide personal information such as their name, date of birth, and BVN.

Okash Loan Requirements

To be eligible for an Okash loan, there are a few requirements that must be met. These requirements include:

- A valid email address

- An Android phone

- Age range of 20-55 years old

- Must be a resident of Nigeria

- A bank account

- A valid BVN (Bank Verification Number)

It is important to note that only those who meet these requirements will be considered for an Okash loan. Additionally, meeting these requirements does not guarantee loan approval.

Advertisement

Okash loan app requires that applicants have a stable source of income to ensure that they can repay the loan. This means that individuals who are currently unemployed or have an irregular source of income may not be eligible for a loan.

How To Apply For Okash Loan

To apply for a loan on the Okash loan app, the user needs to follow a few simple steps. Firstly, the user needs to:

- Download the Okash app from the Play Store and install it on their device.

- Once the app is installed, the user needs to register an account with their Name, BVN, Email, and Phone number.

- After the account is created, the user will be directed to the loan dashboard. Here, the user needs to fill in the blanks with the appropriate details and submit their loan application.

- The user can select the loan amount they would like to apply for from the dashboard, and then provide their personal information and bank details.

- The Okash loan app requires the user to have a valid BVN, a bank account, and a smartphone to be eligible for a loan. The user also needs to be at least 18 years old and have a stable source of income.

- Once the user submits their loan application, it will be reviewed by the Okash team. If the application is approved, the user will receive the loan amount directly in their bank account within a few minutes.

How to check Okash loan balance

To check your Okash loan balance, you can follow these steps:

- Open the Okash mobile application on your smartphone. Ensure that you have the latest version of the app installed. If you don’t have the app, you can download it from the Google Play Store for Android devices or the App Store for iOS devices.

- Log in to your Okash account using your registered mobile number and password. If you haven’t created an account yet, you will need to sign up and provide the necessary information.

- Once you’re logged in, you will be taken to the Okash app dashboard or home screen. Look for the section that displays your loan information or account summary. This section typically provides details about your current loan balance, including the amount borrowed, the remaining balance, and the repayment period.

- Review the loan balance displayed on the screen. It should show the outstanding amount that you owe. If there are any fees or interest charges, they may be included in the balance as well.

How do I contact OKash customer service?

You can reach the Okash customer service unit by phone: 0207659988 or email: help@o-kash.com.

What happens if you don’t pay OKash loan?

Not paying your Okash loan will keep you in default and can affect your credit score, therefore, limiting your access to further loans.

Conclusion:

Applying for a loan on the Okash loan app is a quick and easy process that can be done from the comfort of one’s home. The app requires minimal documentation and provides instant approval and disbursement of the loan amount.

Advertisement