Advertisement

One of the top online lending apps in Nigeria, Xtracash, provides rapid and convenient financial solutions. Unexpected expenses can happen at any time in today’s fast-paced world, and Xtracash is here to give you rapid access to money when you need it most.

With few conditions and a quick approval procedure, Xtracash is to provide a streamlined borrowing experience for any financial emergency, including urgent medical bills, home repairs, and other unexpected expenses.

You can quickly apply for a loan with Xtracash from the convenience of your home using your smartphone. A cutting-edge platform for lending money, Xtracash offers people quick, easy, and convenient short-term loans. The mission of Xtracash, a startup founded by a group of young entrepreneurs, is to advance financial inclusion through easy cash policies.

This cutting-edge lending service is only available through Quickteller, a division of Interswitch, a major player in the financial technology industry. Residents of Nigeria, Ghana, and Zambia can currently get cash loans through Xtracash, which provides a simple and quick process.

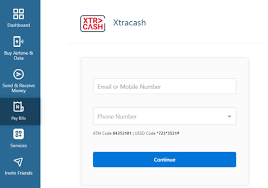

Through the Quickteller website or USSD code, you can easily access money with Xtracash to pay bills, make purchases, send money to friends and family, buy airtime, and even cash out from your mobile device.

Advertisement

Conditions to apply for an Xtracash Loan

In order to be eligible for an Xtracash loan, the following conditions must be satisfied:

- You must not have any unpaid XTRACASH loans.

- be older than 18 years old.

- Possess a solid track record of Xtracash payback.

- Have an account with Quickteller.

- Register a debit card with Quickteller. Customers must also be informed that they can start an early loan repayment process. The service recovers the charge first, then the principle, in the case of incomplete payment. Any debts that are not repaid by the due date are automatically renewed for another month.

How to open an account with Quickteller

To be eligible for an Xtracash loan, a Quickteller account must be set up first. Follow these steps to accomplish this:

- Go to the Quickteller registration page.

- Your first and last names, email addresses, and phone numbers should be entered.

- Make a complex-character password.

- Look for a welcome email from Quickteller in your inbox.

- You can copy the 7-digit activation code from the email and put it on the Quickteller sign-up page.

- Click Continue after that to confirm your phone number.

- On the Quickteller sign-up website, enter the OTP that was texted to your phone. That’s all; your Quickteller account has been successfully created.

Applying for an Xtracash Loan

It’s quite simple to apply for an Xtracash loan; just follow these instructions:

- Obtain Quickteller’s login page.

- Click Login after providing your email address and password.

- On your dashboard, find “Loans” and click it.

- then select “Request Loan.”

- You will see a selection of loan options; find the ones that are for Xtracash; then select the loan amount and term you need.

- Choose the bank to which you want the credit to go now.

- For the transaction to be authorized, enter your password.

Code for Xtracash Loan USSD

Dial *322# and follow the on-screen instructions to acquire the USSD code for the Xtracash lending option.

Loan Repayment for Xtracash

You will receive an SMS reminder from Xtracash when your loan due date is a few days away. You will see a USSD code in this mail that will allow you to pay earlier than the due date as well. Dial *322*6# to pay back your Xtracash loan using the USSD code.

Conclusion

Through their collaboration with Interswitch subsidiary Quickteller, Xtracash offers rapid lending alternatives. Xtracash has your back whether you need money for bill payments, shopping, peer-to-peer transfers, or topping off your cell airtime.

On their smartphones, citizens of Nigeria, Ghana, and Zambia can simply apply for and receive loans. By delivering quick, easy, and dependable financial solutions to satisfy the requirements of people all around the area, Xtracash is revolutionizing the lending landscape.

Advertisement